Today’s inflation data shows that increases in the minimum wage are both necessary and desirable, says CTU Chief Economist Craig Renney.

“Statistics New Zealand data released today showed that Inflation was 5.9% annually, its highest rate since June 1990. Inflation is being driven by the price of building materials, rents, fuel, and the price if second-hand cars. The price of petrol rose 30% annually, and the price of purchasing a new house rose 16% in the latest data.

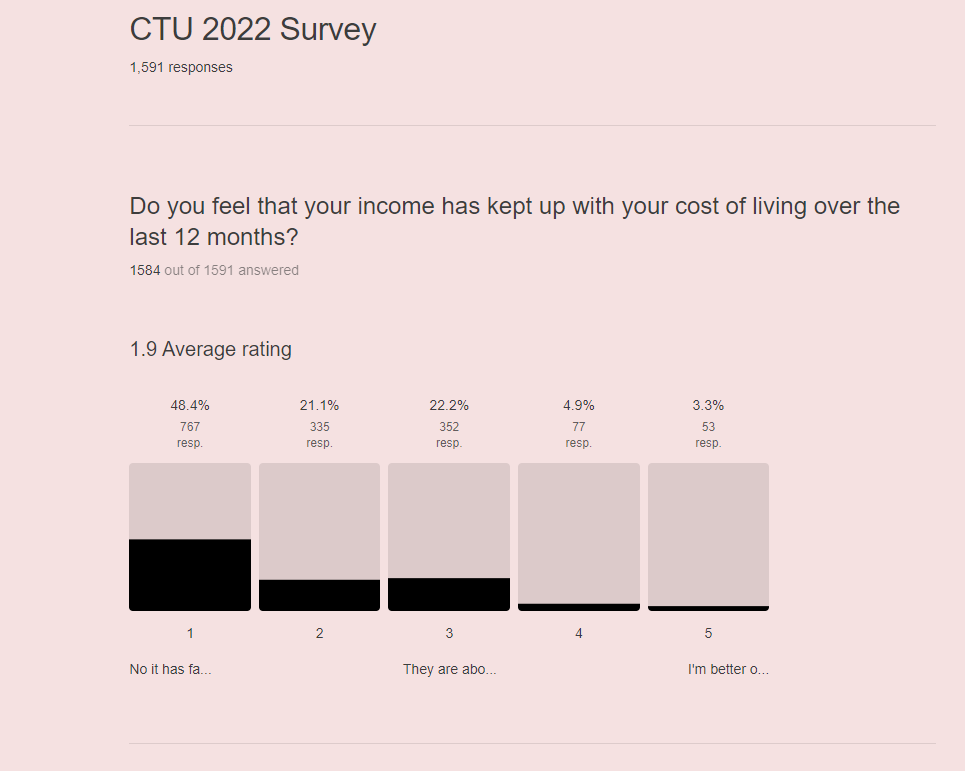

“What is also clear is that workers wages are not driving the current inflation changes. The latest data from on wages from Stats NZ shows that 42% of New Zealand workers did not get a pay rise at all last year. More than 80% of workers are getting pay rises less than inflation. Overall, the Labour Cost Index shows that wages increased 2.4% last year. Whilst some economists may be worrying about a wage/price spiral, we have yet to see increased costs feed their way through to increased wages.

“This inflation data should be treated with some caution as it reflects not just where we are now, but also where we were a year ago. Auckland was just coming out of a level 3 lockdown, and the New Zealand economy was still recovering from previous COVID-19 lockdowns. Some bounce back in prices was inevitable as a consequence. It remains to be seen if prices remain elevated as COVID-19 related lockdowns work their way through the data in the future.

“What is needed now is to make sure that we are protecting those with the least ability to incur higher costs. Businesses can help by making sure that those with the lowest incomes see wage increases that are matching inflation. Government can help by making sure that the minimum wage and welfare at levels that doesn’t see workers fall further behind. What is not needed now is to cut the essential investments which are helping up catch-up on the $75bn infrastructure gap in New Zealand. We can’t cut our way to a more productive, sustainable, and inclusive economy,” says Craig Renney.