Published 1 August 2023

Summary

This document costs National’s current policy proposals for the next election and compares it with the unallocated funding available in future Budgets.

The size of National’s current commitments exceeds the available funding in the operating allowances by $3.3bn–$5.2bn. This estimate does not include billions worth of policy promises that are too vague to quantify. This spending creates a fiscal gap that would need to be filled with additional revenue, additional borrowing, asset sales, or additional spending cuts above what has already been announced.

This exercise does not claim to be a full accounting of National’s policies. It cannot be, due to the vagueness of many of their commitments. However, even the numbers currently available do not add up.

To date, National has committed around $2 for every $1 that is available. This figure makes the most generous assumptions possible for National’s spending programme. It also assumes that no additional spending will be announced by National in the lead-up to the election. This analysis should therefore be considered as the absolute minimum for the spending gap.

National’s announced spending cuts only cover their own proposed new expenditures. Cuts to public services would likely be necessary as a consequence of their currently unfunded tax cuts.

This creates several questions for National to answer:

- What are the details and costs of National’s committed but uncosted policies?

- What is the total fiscal impact of National’s policy platform?

- What would National cut to balance the books?

Budgets and elections are about choices. National should be clear about the choices that it will be making on behalf of New Zealand if elected.

Context

On 19 July 2017, the Labour Party launched its Fiscal Plan ahead of the 2017 Election. That plan set out a fully costed and externally audited plan of expenditure for the incoming Labour-led Government. It demonstrated how Labour would manage its expenditure within the Budget Responsibility Rules. John Key launched the National Party’s spending plans on 3 August 2008. Oppositions that want to show they are ready to form a government provide fully costed plans for the public well ahead of the election.

We are now at a similar point in the electoral cycle, and yet there is no Fiscal Plan or spending document from the National Party ahead of the 2023 election. This is despite the National Party receiving repeated requests to present a plan well ahead of the election, as they themselves had promised.

National has stated many times that it will fund tax cuts while delivering new investment every year on core services such as health and education. When asked how it will pay for those tax cuts, National has claimed it would ‘cut wasteful spending’ without stating what that spending is, or what impact it will have on future Budgets.

The public has no clear understanding of what the National Party would really change in terms of spending, nor how its plans would add up. In short, National is denying the public the chance to make an informed choice ahead of the next election.

The NZCTU has highlighted the costs of the National Party’s proposed tax changes, particularly those associated with the tax thresholds. The National Party accepted those calculations. We have also collected the various commitments made by the National Party as part of this campaign. Our hope is to start to fill that information gap for the public.

The National Party could solve this problem tomorrow. They could release their policy costings, fiscal strategy, and expected Budget. Given the claims they have made about the affordability of their plans, they should be in a position to show this. If they cannot, then they either don’t know, or don’t want the public to know what their plans are. Neither option is acceptable from an opposition party hoping to form the next government.

New Zealanders have a right to know what the main opposition party is promising to offer at the election. Their current proposals raise challenging questions about the mathematics behind them: what changes will occur, when they will take effect, and who will bear the negative consequences of these changes. These are reasonable questions – questions that opposition parties have answered in the past. They should be answered by National now.

National’s fiscal tables

The following tables set out the spending commitments made by National to date.

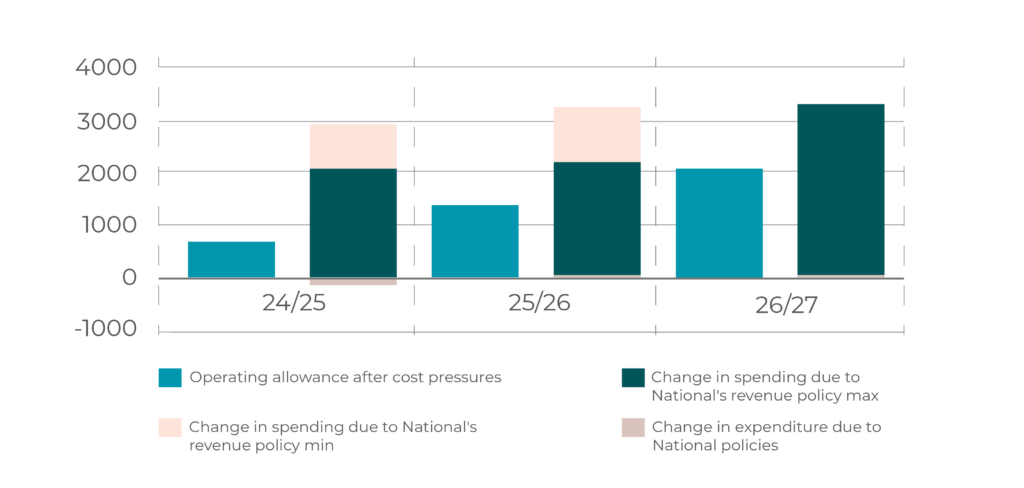

We have set out two options for National’s taxation policy. National has been contradictory in its statements on how it will deliver these policies. On one hand, it said after the 2022 Budget that it would scrap the landlord tax changes ‘immediately’. On the other, National promised to “present a fully-costed tax plan at the election, which will lay out a path to unwind” those tax changes, as well as the Auckland Regional Fuel tax and the Clean Car Discount.

To account for this, we have provided costings on both implementing these policies in what would be their first Budget (Max) and in their third (Min). The Max and Min reflects the fact that the earlier that these tax cuts are brought in, the more that they will cost. This latter approach is the most conservative – giving National the greatest fiscal space. If they chose to bring them in earlier, then the costs would subsequently rise closer to the Max option. This provides a range in which we expect the final costs to settle.

National is denying the public the chance to make an informed choice ahead of the next election.

Costed policies, revenue and operational spending ($m)

| Fiscal Year | 24/25 | 25/26 | 26/27 |

| Budget | 24 | 25 | 26 |

| National’s costed policies | |||

| Revenue changes ($m) | |||

| Partial Indexation (11.5% threshold increase) | -1904 | -2037 | -2085 |

| Interest deductions for rentals | -490 | -650 | -650 |

| Loss-ring fencing | -190 | -190 | -190 |

| Auckland Fuel Tax | -150 | -150 | -150 |

| Bright Line test back to two years | -50 | -50 | -50 |

| KiwiBuild sales revenue* | -92 | -92 | -92 |

| GST on delivery services | -47 | -47 | -47 |

| Total revenue changes min | -2043 | -2176 | -3264 |

| Total revenue changes max | -2923 | -3216 | -3264 |

| Operating expenditure changes | |||

| Mental Health Fund | 5 | 5 | 5 |

| Free School Meals | 165 | 165 | |

| Reinstate the Children’s Commissioner | 2 | 2 | 2 |

| Youth Offending Programmes | 25 | 25 | 25 |

| Childcare Boost | 249 | 249 | 249 |

| Extend Breast Cancer Screening | 10 | 10 | 10 |

| Scrap Teacher Registration Fees | 16 | 16 | 16 |

| Nurses student loan and Bonding | 56.8 | 56.8 | 56.8 |

| Welfare that Works | 14.8 | 25.3 | 35.8 |

| Biotech Regulator | 5 | 5 | 5 |

| New Medical Staff | 2.1 | 7.2 | 16 |

| Build for Growth payments | 378 | 378 | 378 |

| Cut contractor spending | -400 | -400 | -400 |

| Cancel GIDI | -124 | -124 | -124 |

| Cancel free ECE for two-year-olds | -367 | -372 | -375 |

| Total operating expenditure changes | -128 | 48 | 64 |

Costed policies, capital expenditure and MCAs*

| Capital expenditure changes ($m) | |

| Capital cost of new medical school, govt contributions | 280 |

| Cancel Affordable Housing Fund | -235 |

| Cancel Buying off the Plan | -272 |

| Cancel Kainga Ora Land Programme | -219 |

| Cancel Housing Acceleration Fund | -410 |

| Total capital expenditure changes | -856 |

Note: National frequently mentions cutting Auckland Light Rail to free up funds. However the current National Land Transport Plan, expiring at the end of 2023/24, has not allocated funding beyond this period, meaning this policy does not actually free up any funding.

Currently uncosted policies

These policies would cost in the billions of dollars, a mix of operating and capital.

Oppositions that want to show they are ready to form a government provide fully costed plans for the public well ahead of the election.

Fiscal balance ($m)

| Fiscal Year | 24/25 | 25/26 | 26/27 | 3-year total |

| Operating allowance | 3500 | 7000 | 10500 | 21000 |

| Funding needed to maintain service levels | 2800 | 5600 | 8400 | 16800 |

| Operating allowance available for new policies | 700 | 1400 | 2100 | 4200 |

| Change in revenue due to National policies min | -2043 | -2176 | -3264 | -7483 |

| Change in revenue due to National policies max | -2923 | -3216 | -3264 | -9403 |

| Change in expenditure due to National policies | -128 | 48 | 64 | -15 |

| Operating funding gap min | 1215 | 824 | 1228 | 3268 |

| Operating funding gap max | 2095 | 1864 | 1228 | 5188 |

Cuts necessary to fill the fiscal gap

As it stands National’s plan does not add up. There is a funding gap of nearly $3.3bn–$5.2bn just on the costable policies announced so far. There are four ways in which this funding could be found.

Additional revenue: National has strongly criticised the amount of revenue the government is raising, so this option appears unlikely.

More debt: National have said they will not borrow to pay for their tax cuts and have criticised the current level of government debt.

Asset sales: National-led governments have in the past used asset sales as a means of generating revenue. National ruled out asset sales in 2022, (Pre-Election Economic and Fiscal Update (PEFU)) so this is probably not a viable approach. Both of these factors mean that further spending cuts are the only way in which the books can be balanced.

Spending cuts: The size of the cuts necessary to balance the budget is very significant: $3.3bn–$5.2bn. National’s fiscal gap amounts to 20% of this remaining spending. Cutting those services would be well beyond the scope of cosmetic tinkering or removing a few communications staff. This would see progress in many areas stalled or ended, as funding would simply not be in place.

While it is true that the government spends a significant amount of money each year, only a small amount of this is available for government discretion.

For example, Core Crown government spending for 2022/23 was $128bn. 73% of that spending is superannuation, health, education, Working for Families, benefits, and housing support. Transport, law and order, and defence are another 12%. Interest on debt is 5%.

The remaining 10%, or $12.8bn a year, pays for every government department, the environment, water infrastructure, heritage, economic development, tax collection, climate change, rural communities, food and agriculture support. It pays for Māori Development, Pacific Peoples Ministry. It covers research and development, Foreign Affairs overseas assistance, and disaster assistance. It pays for every other activity of government.

This impact doesn’t end in the first year. It is clear that the size of the cuts would continue for a number of years – especially given the need to make changes each year. We also have no clarity on how the currently uncosted elements of the programme would be paid for, nor how any emergencies, contingencies, or emerging needs will be paid for. Maintaining fiscal balance will mean even larger cuts, likely in the billions of dollars.

Background information

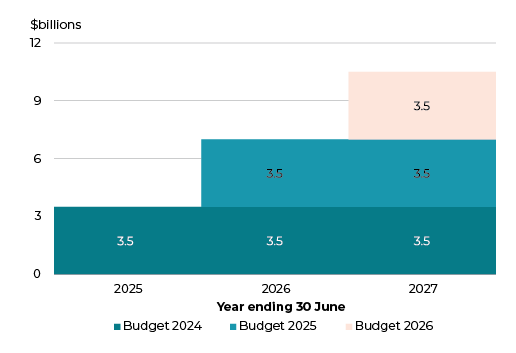

Operating Allowances

In Budget 23, the Government set out the operating allowances for the next three Budgets. These are $3.5bn per year, and are cumulative. That allowance has to contain all the new operating spending, including any spending (outside some welfare payments) that is associated with cost-of-living increases.

Cost pressures

Each year, public services face increased cost pressures due to factors such as inflation, the growing population, and demographic shifts (e.g. population ageing). If these cost pressures are not met by increased funding, service levels decline. For example, more students per teacher, fewer police relative to population, fewer operations relative to need. This money is not a new investment. It doesn’t buy better services, or anything new – like new drugs for Pharmac for example. It simply retains the current level of service provision.

Any ‘new’ investment needs to be in addition to this inflation cost. In Budget 2023 Treasury states that $2.8bn of the $3.5bn operating allowance will be needed to cover cost pressures from inflation and wage growth alone. Effectively, this leaves $700m a year for the net cost of any new initiatives.

Treasury states “based on a high-level analysis, when adjusted for expenditure that is already indexed (e.g., main benefit types) or spending that is time-limited in nature, or spending not sensitive to inflation, Treasury estimates that department baseline expenses could need to increase by $2.8bn in the future to maintain the level of existing services for the impact of inflation and wage growth forecast in the future” (p.41, BEFU, Treasury 2023).

The Treasury is keen to show that this is a conservative approach. They show that this number does not include any changes associated with population or demographic changes. As they state “This analysis focuses on the expected price changes in Government services. However, there could also be additional demand (eg, population changes) that could add extra pressure to future Budget allowances”. This $2.8bn figure should be considered a low estimate of the likely cost pressures in future.

Contingencies

In addition to cost pressures and the cost of National’s new policies, it would be prudent to retain some unallocated funding for any contingency or any emerging expenditure needs. Furthermore, a major party must consider that it will likely have to find funds for the policies of its governing partners. As National has not committed to any contingency we have not incorporated this into the analysis. However, we would expect that the National Party’s Fiscal Plan would set out a level of future contingency in its expenditure programme when delivered.

In 2017, the Labour Fiscal Plan left money aside each year for these sorts of unforeseen events and needs. Assuming that $0.5bn as an unallocated spending contingency was set aside per Budget, which would be a remarkably low amount, this would add $3bn across the forecast period in new costs.

Without any contingency, the government will be required to borrow or make further unplanned cuts during the year. Neither of these positions is a desirable place to be. Bond markets don’t react well to high levels of uncertainty around government borrowing, and programmes of government need spending certainty so that they can be delivered effectively.

Without any contingency funding, future Budgets will be shorter affairs as there is no new money (save for further cuts or new borrowing) to expense. National’s current fiscal strategy would suggest that there is nothing new fiscally in any of the two Budgets that follow the first Budget in 2024.

Costing National’s policies

The NZCTU has been analysing the costs of Nationals proposed policies. There are essentially two types of policy. Those with a cost provided by National, and those where proposed costings have yet to be provided. In every instance, we have been as conservative as possible. We have used National’s own costings, and official costings from government agencies.

We have taken publicly available data from the last Budget and used this to create an envelope of possible spending. All numbers used here have either been provided by the National Party, the Treasury, or by the Reserve Bank. We have not changed any of the fundamental settings of the economy or of the economic modelling provided by the Treasury. These are all available through the publicly available Fiscal Strategy Model. It is not valid to assume different rates of growth or another economic changes when creating a fiscal plan.

We have taken all of National’s costings at face value. There are many instances in which the costings provided by National could be challenged. But for the purposes of clarity and integrity, we have retained all of their numbers as published, where they are publicly stated by others (i.e. IRD, Treasury), or where they have agreed with public commentary on cost (such as the NZCTU’s costing of their tax indexation policy).

We have assumed the operating and capital allowances set by the government remain. Any increase to these allowances would need to be met through increased borrowing or through additional revenue generation. The National Party to date has not indicated that it would be keen to pursue these routes.

We have costed the policies across the next election period. This is in line with historical practice and reflects the fact that control of spending is only guaranteed by the government of the day.

Policies that can’t be costed. There are a number of other commitments that have been made by the National Party that would have significant fiscal consequences that we are unable to cost due to lack of detail and lack of costing from National. For example:

- National’s policies to increase prison sentences. It costs around $150,000 in operational expenditure for a prisoner for a year. National does not know how much it would increase the prisoner headcount but if prisoner levels rose back to their peak in 2018 it could cost around $250m a year in new expenditure.

- National leader Christopher Luxon has said “Nicola and I want to make sure that we continue to increase investment in health and education every single year”. If that is a “real” increase, as opposed to just meeting cost pressures, additional funding would be needed. Even a very small investment (say $100m each for health and education) would require an additional $1.2bn across the forecast period.

- Another area here where costs can’t be calculated is the minimum wage. National has said that increases to the Minimum Wage were “something we did every year that we were in office, and it’s something we commit we will do if elected in October” (p.41, BEFU, Treasury 2023). Increasing the Minimum Wage increases labour costs to government, but the scale is unquantifiable without knowing what the increases would be.

- National has committed to “Build enough state and social housing so that there is no social housing waitlist” but it is unclear how many homes they mean and over what timeframe. Right now, this would involve building something in the order of 24,000 new homes.

- ‘Building Depreciation for Build to Rent’ policy. This is a potentially very large tax concession for owners of such properties, but it is unclear if National intends this only to apply to new properties or existing properties, and how many properties would be affected.

Additional policies will mean additional costs. This analysis deals only in policy announcements National has made to date. Any further policy announcements with fiscal impacts will alter these numbers, likely increasing the fiscal gap.

As a consequence, this analysis should be considered the bare minimum of the size of the challenge facing National. There are likely to be many billions more dollars in spending necessary to meet National’s existing policies, those of its governing partners, contingencies, and any further policies National announces.

Note on Treasury practice for recognition of savings. Savings from stopping programmes or reducing programme expenditure are a legitimate means of balancing the books. There are rules around when a saving can be incorporated into the Budget to pay for spending. In general, two things are required to be present – transparency and certainty. A saving can only be incorporated into Budget analysis if it is clear what is going to be cut, and when it will be cut.

Unless any political party – including National – can show what it will cut, when, and how, that cut should not be incorporated into the accounts. Helpfully for all political parties, all of the information necessary has been publicly available since the date of Budget 23. That data will not be updated at the PREFU7 – meaning that there is no need to wait for that information before demonstrating why and how cuts should take place.

This is important because claims for ‘efficiency savings’ or other measures need to be verified. For example, if National were simply to claim that they would find efficiencies then they have to show what would be cut. To their credit, other political parties (ACT, Greens) have identified their sources of change in their fiscal plans.

An example here is the proposed cut of $400m to contractor spending by the government. Without clarity of what contractor spending will be cut, by whom, when, and how, it shouldn’t be incorporated into the accounts. It becomes a positive ‘Specific Fiscal Risk’. It also assumes that this expenditure doesn’t simply create new expenditure elsewhere (as the work may be carried out by new public servants). For the purposes of this analysis we have allowed National to use this as a saving.

The ball is in National’s court, and their actions will determine the level of trust they can earn from the public.

Conclusion

The National Party needs to demonstrate transparency and accountability if it wants to be taken seriously as a potential ruling party. By releasing their policy costings, fiscal strategy, and expected Budget, they can demonstrate their ability to govern.

Failure to do so raises concerns about their true intentions and casts doubts on their competence to lead. New Zealanders deserve to be fully informed about National’s plans. Anything less is unacceptable from an opposition party aspiring to shape the country’s future. The ball is in National’s court, and their actions will determine the level of trust they can earn from the public.

Authorised by Richard Wagstaff, Level 3, 79 Boulcott St, Wellington, 6011