New Zealand Council of Trade Unions analysis has revealed that a select group of landlords would be made tax-cut millionaires if Christopher Luxon’s landlord tax breaks are delivered after 14 October.

NZCTU Economist Craig Renney said “National waited until the very last moment to tell New Zealanders about their tax and fiscal plans. Day after day their numbers are being challenged.

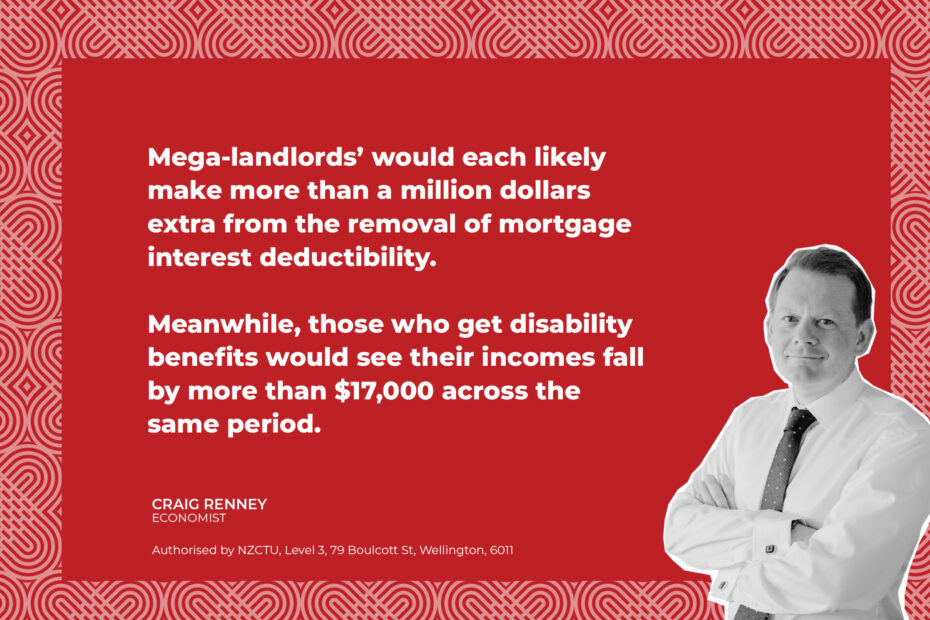

“Now, we can reveal another harsh and unfair reality of their tax plan. ‘Mega-landlords’ would each likely make more than a million dollars extra from the removal of mortgage interest deductibility. Meanwhile, those who get disability benefits would see their incomes fall by more than $17,000 across the same period.

“Over five years, Nationals tax cuts would give $1.3 million to each of those landlords with more than 200 properties. This is based on the average benefit that landlords would get. Over five years this group of 346 mega-landlords would collectively gain nearly half a billion dollars in tax breaks.

“We know this windfall gain would not be passed on in lower rents, but would just further fatten the bank accounts of landlords.”

These figures have been independently verified by Terry Baucher, taxation specialist at Baucher Consulting.

Renney said “Christopher Luxon clearly wants to cut public services and will likely have to go further than planned because his foreign buyer’s tax and casino tax don’t add up. But National has not been upfront with voters about who gains from his tax policy. Last week we discovered that only 3,000 households would get the much claimed $250 a fortnight benefit. Now we discover that around 300 landlords would make millions.

“This is just another example of National’s reverse Robin Hood tax plan. We found out only last Friday that National plans to take $2 billion off those on benefits, including disabled people, to help fund its tax cuts. Our most marginalised would suffer while rich landlords get even richer.”

“National’s tax plan would overwhelmingly enrich those who already have significant assets – while harming those with the least. National should scrap their unfair and unreliable tax plans which are balanced on the backs of the most vulnerable. They shouldn’t have to pay the price of National’s plan.”

Disabled community advocate Henrietta Bollinger said this policy was unaffordable for disabled people and their whānau.

“It completely fails to account for the reality of disability, the number of barriers we face in housing, education, employment, or healthcare that may lead us to rely on welfare. It completely fails to account for the hidden costs of disability.

“It also completely fails to recognise the financial pressures disabled people are already under.

Instead of choosing to stand with around 24% of the population, their families, and communities National are choosing as a prospective governing party to stand with a privileged few.”

Systemic advocate Rhonda Swenson, who is on a supported living benefit, said the proposed changes will see disabled people falling further behind.

“For me, $17,000 is just under a year’s salary. It just makes it harder in terms of buying food and the basics.

“It makes me angry, it means they’re not valuing the people at the bottom. The disabled community deserves to be respected. [These cuts] will tip some people over the edge. They will make people more desperate.”

What is the size of tax cuts for Mega-Landlords under National’s tax plan?

National’s policy is to restore interest deductibility for rentals in 25% steps, until it is fully restored from 1 April 2026.

Background

- IRD has calculated the revenue that the removal of interest deductions will bring in rises to $760m once fully implemented. https://www.documentcloud.org/documents/23978406-interest-deductibility-doc)

- We have costed National’s policy using IRD’s figures and National’s 25% re-phase-in of deductibility (National’s fiscal plan still uses the outdated figures from the RIS when the interest deductibility legislation was passed).

- This creates a total cost of $3.4b over five years. The extra is made up from the change in the cost (https://www.newsroom.co.nz/nationals-landlord-tax-break-could-cost-100m-more-a-year) and the extra fiscal year.

- There are 510,000 private rentals.

https://d39d3mj7qio96p.cloudfront.net/media/documents/ER78_The_New_Zealand_Rental_Sector_2022.pdf - This means that National’s policy would be worth an average of $6,700 per rental over 5 years.

2021 MBIE data shows 346 ‘Mega-Landlords’ own at least 200 properties each. - ttps://www.stuff.co.nz/life-style/homed/real-estate/124320645/nearly-80-per-cent-of-landlords-own-just-one-property-data-shows

- Assuming these Mega-Landlords own only 200 properties each and they have as much mortgage debt on average as the average landlord (it is in fact, probably higher), they would get an average tax cut of $1.3m over five years.

- In total these 346 Mega-Landlords would receive $464m over five years.

- At the same time National would help pay for this change by changing the indexation of main benefits to CPI rather than wages.

- A single person on disability benefits would lose more than $17,000 as a consequence of this change over the same period.

Landlord Expenses Table

| 24/25 | 25/26 | 26/27 | 27/28 | 28/29 | Total | |

| IR Costing | $522,500,000 | $617,500,000 | $760,000,000 | $760,000,000 | $760,000,000 | $3,420,000,000 |

| Number of private rentals | 510,000 | 510,000 | 510,000 | 510,000 | 510,000 | |

| Per rental | $1,025 | $1,211 | $1,490 | $1,490 | $1,490 | $6,706 |

| Number of Mega-Landlords | 346 | |||||

| Minimum rentals per Mega-Landlord | 200 | |||||

| Average per Mega-Landlord | $1,341,176 | |||||

| Mega-Landlords total tax cut | $464,047,059 |

Beneficiaries Calculations

| Year | 2023/24 (Current) | 2024/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 | ||

| Rates | Wages (FSM) | 7.29% | 6.53% | 5.59% | 4.40% | 3.74% | 3.19% | |

| CPI (FSM) | 6.03% | 3.78% | 2.47% | 2.15% | 2.01% | 2.00% | ||

| Single 18+ years | Wages | $786.69 | $838.06 | $884.91 | $923.84 | $958.39 | $994.72 | |

| CPI | $816.43 | $836.59 | $854.58 | $871.76 | $889.19 | |||

| Diff | -$21.63 | -$48.32 | -$69.26 | -$86.64 | -$105.53 | Total | ||

| Annual | -$1,124.97 | -$2,512.42 | -$3,601.78 | -$4,505.27 | -$5,487.45 | ($17,231.89) |