Budget 2023 provides targeted investments to support Kiwi families with the cost of living and support the wellbeing of the most vulnerable in our society.

The extension of subsidised ECE to 2-year-olds, the removal of the $5 prescription co-payment, the expansion of the Warmer Kiwi Homes Programme and the Healthy School Lunches Programme, and the lifting of main benefits to the rate of inflation will make meaningful differences for many New Zealand households.

“We welcome the removal of the minimum wage exemption for disabled workers, which has been a long-standing discrimination. We have fought hard to remove this as disabled workers deserve to be paid the same as anyone else doing the same work.”

Kerry Davies, PSA National Secretary

STATE OF THE SECTOR

In the Budget Policy Statement released in December, Finance Minister Grant Robertson set out that the Government’s “primary focus at the Budget will be on supporting families and households experiencing cost of living pressures”. These cost-of-living pressures have been driven both by high consumers price inflation and rising mortgage rates.

One means of alleviating cost of living pressures is to increase working peoples’ incomes. While for much of the economy, the levers available to the Government to raise incomes are indirect, in the past year the Government has assisted struggling kiwi households by:

- Continuing to increase the minimum wage and welfare benefits;

- Extending the petrol levy discount to the end of June 2023;

- Providing the three ‘cost-of-living’ payments in 2022; and

- Increasing superannuation payments.

The Government also has the power to directly improve wages for the 395,000+ people working in public services and publicly funded sectors. Public and community workers have worked under constrained pay since the pandemic started. This has compounded skills and labour shortages, creating significant and unsustainable workloads for many public-sector workers and in some cases negatively impacting the provision of public services.

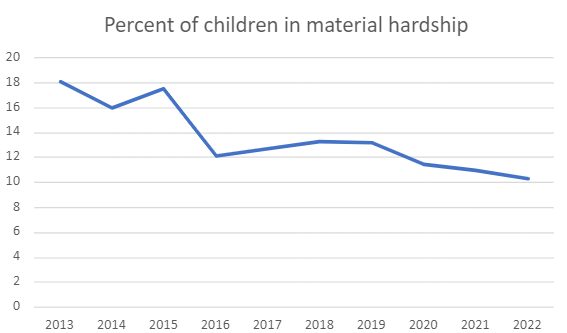

Child poverty has been a major focus of the Labour Government since coming to power. Some progress has been made here, with the percentage of children living in material hardship falling from 13.3% in 2018 to 10.3% in 2022. (Material hardship is defined as being in a household that lacks 6 or more of 17 consumption items that most people regard as essential.) In real terms, there are still approximately 119,000 children living in material hardship. A disproportionate number of these children come from Māori and Pasifika families. Work to reduce child poverty rates must therefore remain a priority – it is difficult to imagine a more “bread and butter” issue.

BUDGET ACTIONS

Budget 23 makes a number of targeted but significant investments to support wellbeing and social development. These investments are primarily focused on supporting families with the cost of living. The largest investments are:

- The $5 prescription co-payment has been removed for all New Zealanders. This will benefit low-income households the most and cost a total of $618.6 million over four years.

- The 20-hours ECE subsidy is being extended to two-year-olds (from the current three- to five-year-olds). Based on average costs in 2023, families who were not previously receiving childcare subsidies would save an estimated $133.20 a week in childcare costs if a two-year-old child attended ECE for at least 20 hours per week. This is expected to cost a total of $1.2 billion over the forecast period.

- $402.6 million will support the extension and expansion of the Warmer Kiwi Homes Programme beyond June 2024. This will help to make a further 100,000 homes warmer through insulation retrofitting, cost-efficient lighting, and new hot-water appliances.

- $323.4 million total operating funding is being provided to continue delivering free lunches in schools. This has been estimated to save a family with two students, on average, $60 per week.

- Lifting main benefits by 7.22% to be in line with inflation. This investment of $311.3 million will support approximately 354,000 people with the cost of living.

- Expanding the Community Connect public transport concession, with ongoing half-price public transport fares for under 25-year-olds and free public transport for children under 13 (this is discussed in more detail in the Transport section of the CTU Budget Response).

There are also some notable smaller investments in Budget 2023. Providers of the Building Financial Capability have been allocated $29.2 million to deliver financial advice and debt services across the country. This includes meeting demand for one-to-one services, peer-led support, and wraparound support for people with complex needs. There is also $28.5 million provided for Food Secure Communities initiatives, such as funding for the New Zealand Food Network to distribute bulk, surplus food to communities who need it most. $6 million of this investment is for food support in regions affected by the recent weather events.

The Training Incentive Allowance is being permanently reinstated to support sole parents, disabled people, and their carers to study by assisting with associated costs. $80.1 million in operating and $47.5 million in capital has been allocated for this initiative. Disabled New Zealanders will also be supported into work through six trial health and employment services in the Oranga Mahi programme, at a cost of $36.3 million over the forecast period.

CTU ANALYSIS

It is unquestionable that these measures will have positive impacts for some of the vulnerable groups in New Zealand. For those on the lowest-incomes, continuing to lift benefits at the rate of inflation will have the biggest financial impact. Permanently reinstating the Training Incentive Allowance will allow people to build their skills and increase their lifetime earnings.

Those with younger families will benefit from free public transport for children and the expansion of ECE funding to two-year-olds. For disabled New Zealanders, the removal of the minimum wage exemption and the funding for health and employment services have been hard won and offer pathways to more decent lives.

By maintaining funding for the agencies such as MSD, and community organisations that support our most vulnerable, this Budget ensures that people can continue to access the services they rely on. Funding the equal pay settlements in this sector, including for social workers, and removing the pay disparity between those working for agencies and for community organisations will also help address worker shortages and ensure people get the help they need.

In the coming years, we want to see Government taking further steps to lift wages and reduce the costs of essential goods and services. It is encouraging that Budget 2023 has allocated $28.8 million to fund the Commerce Commission to monitor the grocery industry and undertake reporting and enforcement roles focused on improving competition and fair trading. Over the longer-term, this may help to bring down food prices – which have been one of the major drivers of the rising cost of living.